Sell structured insurance settlements is a topic that can change your financial future. If you’re sitting on a structured settlement, you might be wondering how to convert those future payments into cash today. This process can be both beneficial and tricky, offering a mix of rewards and challenges that many people face. In this overview, we’ll break down the ins and outs of selling your structured settlements, making it easier for you to navigate this financial decision.

Understanding structured insurance settlements means grasping how they work and the pros and cons of selling them. We’ll dive into real-life examples, the process you need to follow, who might buy your settlement, and the legal aspects you should consider. With this knowledge, you’ll be well-equipped to make informed decisions.

Understanding Structured Insurance Settlements: Sell Structured Insurance Settlements

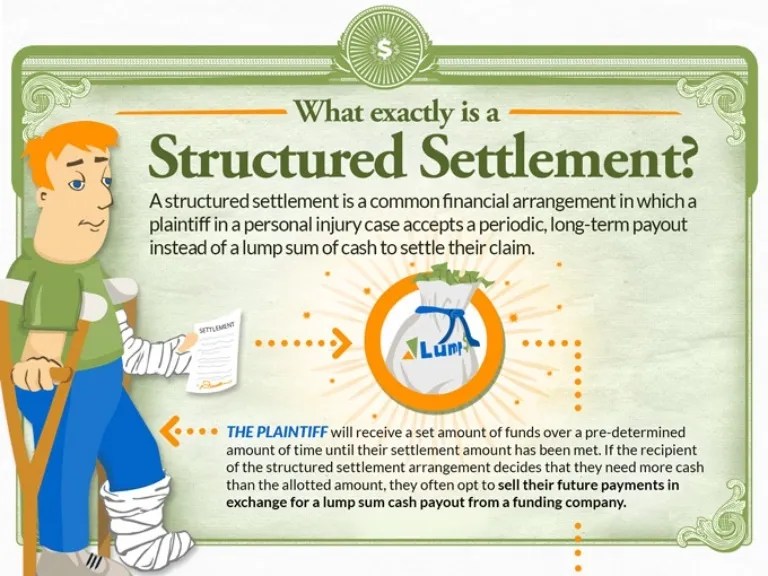

Structured insurance settlements are financial agreements that result from legal claims or personal injury cases, wherein the claimant receives compensation in a series of periodic payments rather than a lump sum. This arrangement is often established to provide long-term financial security for the individual, ensuring a steady income stream over time. These settlements can be tailored to fit the claimant’s specific needs, taking into account factors such as living expenses, healthcare costs, and future financial obligations.

The mechanics of structured settlements typically involve insurance companies or third-party administrators managing the payout process. A plaintiff may agree to a settlement that specifies a certain amount of money to be paid out over a defined period, which can span years or even decades. Payments can be scheduled monthly, annually, or in any custom format that suits the claimant’s financial planning.

Advantages and Disadvantages of Selling Structured Settlements

Selling structured settlements can be a significant financial decision that comes with its own set of pros and cons. Understanding these can help individuals make informed choices about their financial future. Here’s a look at some key advantages and disadvantages associated with selling structured settlements:

The benefits of selling structured settlements include:

- Immediate Cash Access: Selling a structured settlement provides individuals with immediate cash, which can be crucial for addressing urgent financial needs or investments.

- Debt Clearance: The influx of cash can help clear debts or outstanding bills, providing relief from financial stress.

- Investment Opportunities: Recipients may choose to invest the lump sum in assets that could potentially yield higher returns than the structured payments.

- Flexibility in Spending: With a lump sum, individuals have the freedom to allocate their money as they see fit, rather than adhering to a fixed payment schedule.

However, selling structured settlements also carries risks and disadvantages, such as:

- Loss of Future Income: Selling a structured settlement means relinquishing future payments, which could impact long-term financial stability.

- Potentially High Fees: The transaction may incur significant fees and costs, reducing the overall amount received.

- Tax Implications: Depending on the circumstances, selling a structured settlement may result in tax liabilities that need to be considered.

- Emotional Considerations: Individuals may face emotional challenges when parting with a structured settlement, which was designed to provide long-term security.

Real-Life Examples of Selling Structured Settlements, Sell structured insurance settlements

Many individuals have made the decision to sell their structured settlements to meet various financial goals or needs. For instance, consider the case of a young woman who received a structured settlement after an injury accident. Initially, the periodic payments suited her long-term needs. However, when an unexpected medical expense arose, she opted to sell part of her settlement. This decision allowed her to cover the costs quickly while still retaining some future payments.

Another example includes a retiree who faced rising living costs and decided to sell a portion of their structured settlement. This choice provided the necessary cash to supplement their income, allowing for a more comfortable retirement without financial strain. These scenarios illustrate that selling structured settlements can provide quick financial relief, though each decision should be carefully weighed based on individual circumstances and priorities.

The Process of Selling Structured Insurance Settlements

Selling structured insurance settlements can be a strategic decision for individuals needing immediate access to cash. The process might seem complex, but understanding the key steps involved can simplify it considerably. This guide walks you through the necessary actions and considerations when embarking on this financial journey.

Step-by-Step Procedure in Selling Structured Insurance Settlements

Engaging in the sale of structured settlements entails several clear steps. This structured approach ensures that sellers are equipped with the right information and documentation to facilitate a smooth transaction.

- Research Buyers: Start by researching companies that specialize in purchasing structured settlements. Look for reputable firms with good reviews and transparent practices.

- Request Quotes: Contact selected buyers to request quotes. Provide them with details about your settlement to obtain tailored offers.

- Evaluate Offers: Compare the offers received. Consider both the amount and the terms attached to each offer to determine which suits your needs best.

- Submit Documentation: Prepare and submit the required documentation to the chosen buyer. This includes your settlement agreement and proof of identity.

- Legal Approval: Once the buyer reviews your documents, you will need to undergo a court approval process where a judge will confirm the sale’s legality.

- Receive Payment: After court approval, the buyer will disburse the agreed-upon amount, giving you immediate access to funds.

Documentation Required for Initiating the Selling Process

Proper documentation is essential to ensure a smooth transition when selling structured settlements. Sellers should prepare the following documents:

Essential paperwork includes the original settlement agreement, proof of identity, and sometimes tax documents.

- Settlement Agreement: This legal document Artikels the terms of your structured settlement and is crucial for verifying ownership.

- Proof of Identity: Government-issued ID (like a driver’s license or passport) is needed to confirm your identity during the transaction.

- Tax Documents: If applicable, provide any tax-related documents that may be required by the buyer or for legal purposes.

- Payment History: A record of your payment history can help in evaluating the structured settlement’s value.

Key Factors Influencing the Valuation of Structured Settlements

The valuation of structured settlements is influenced by various factors that potential sellers should understand. These factors can significantly impact the amount of money offered by buyers.

The present value of future payments and prevailing interest rates are crucial elements in determining valuation.

- Payment Schedule: The frequency and amount of future payments play a significant role in determining the settlement’s current value.

- Interest Rates: Current market interest rates can affect valuation; lower rates may increase the value of future cash flows.

- Life Expectancy: For settlements based on life insurance, the expected lifespan of the payee can influence the settlement’s value.

- Market Demand: The demand for structured settlements in the secondary market can also influence how much sellers can receive.

Finding Buyers for Structured Insurance Settlements

When it comes to selling structured insurance settlements, finding the right buyers is crucial. Different types of companies and individuals are involved in this market, each with unique approaches and terms. Understanding who these buyers are can help you navigate the selling process more effectively and secure the best deal for your future payments.

There are various buyers in the structured insurance settlement marketplace, including specialized companies, financial institutions, and individual investors. Each buyer may have different motivations and criteria for purchasing settlements, which can influence the offer you receive. Familiarizing yourself with these buyers can ensure you approach your sale with the right expectations and strategies.

Types of Buyers for Structured Insurance Settlements

Several entities engage in the purchase of structured insurance settlements. Each type of buyer has its own approach, terms, and advantages.

- Specialized Structured Settlement Companies: These companies focus exclusively on buying structured settlements. They often have streamlined processes and can provide quick offers based on the terms of your settlement.

- Financial Institutions: Banks and investment firms sometimes buy structured settlements as part of their investment portfolios. They may offer competitive rates but require thorough documentation and a review process.

- Private Investors: Individual investors also purchase structured settlements. They may be more flexible with terms but can vary significantly in their offers and negotiation styles.

To find reputable companies known for buying structured settlements, consider the following well-established entities that have a track record of fair dealings:

- J.G. Wentworth: A pioneer in the structured settlement purchasing industry, offering competitive rates and a straightforward process.

- Peachtree Financial Solutions: Known for personalized service and flexible options when it comes to selling structured settlements.

- Stone Street Capital: Offers transparent pricing and a quick turnaround for sellers looking to access funds quickly.

When negotiating the best price for your structured insurance settlement, several strategies can enhance your outcomes. These tips can help you secure a favorable deal:

- Do Your Research: Understand the market value of your structured settlement. Obtaining quotes from multiple buyers will give you a benchmark for negotiations.

- Know Your Settlement Details: Be well-versed in the specifics of your settlement, including payment amounts, frequency, and duration, as these will influence the buyer’s offer.

- Consider Timing: The market for structured settlements can fluctuate. Selling during a peak period may yield better offers than during a downturn.

- Be Prepared to Negotiate: Don’t accept the first offer. Many buyers expect negotiation, so be ready to discuss terms and present counteroffers.

“Understanding your options and being informed about the buyers can significantly impact the value you receive for your structured settlement.”

Legal Considerations in Selling Structured Insurance Settlements

Navigating the legal landscape when selling structured insurance settlements is crucial for ensuring a smooth transaction. There are several legal requirements and implications to be aware of, primarily revolving around court approval and tax consequences. Understanding these aspects can prevent unforeseen complications and maximize the benefits of the sale.

Legal Requirements Before Selling Structured Insurance Settlements

Before an individual can sell their structured insurance settlement, certain legal requirements must be satisfied. These requirements are designed to protect the seller’s interests and ensure that the transaction is conducted fairly. Key legal considerations include:

- State Regulations: Each state has its own regulations regarding the sale of structured settlements. Sellers must be familiar with their state’s laws to ensure compliance.

- Disclosure of Terms: Sellers are required to disclose all terms associated with their structured settlement, including payment schedules, the total amount, and any fees that may be incurred during the sale.

- Judicial Approval: In many states, court approval is mandated before a structured settlement can be sold. This is to confirm that the sale is in the seller’s best interest.

Court Approval in the Selling Process

Court approval plays a pivotal role in the transaction of selling structured insurance settlements. This legal step ensures that the sale is fair and beneficial to the seller. The implications of court approval include:

- Validation of the Sale: The court assesses whether the sale is in the best interests of the seller, taking into consideration their financial needs and the proposed selling price.

- Protection from Fraud: By requiring court oversight, the system helps protect sellers from potential exploitation by buyers who may offer unfair terms.

- Costs and Time Considerations: Obtaining court approval can involve additional costs and time, as it necessitates legal paperwork and possible court appearances.

Potential Tax Implications When Selling Structured Insurance Settlements

Selling a structured insurance settlement can have tax implications that are important for individuals to consider. Understanding these implications can help sellers make informed decisions regarding their financial futures:

- Tax-Free Payments: Generally, the payments received from structured settlements are tax-free. However, once sold, the proceeds from the sale may be subject to taxes.

- Capital Gains Tax: If the structured settlement is sold for a profit, sellers might need to pay capital gains tax on the difference between the selling price and the original value of the settlement.

- Consultation with Tax Professionals: It is advisable for sellers to consult with tax professionals prior to selling to fully understand the tax obligations that will arise from the transaction.

“Understanding the legal landscape of selling structured insurance settlements is crucial to protecting your financial interests.”

If you’re looking for reliable coverage, allstate insurance tulsa ok offers a variety of plans tailored to meet your needs. It’s a great option for anyone in Tulsa wanting peace of mind without breaking the bank. Plus, the customer service team is always ready to help with any questions you have about your policy.

On the other hand, if you’re in the Gallatin area, you might want to check out allstate insurance gallatin tn. They provide personalized service and a range of products to fit different budgets. It’s definitely worth exploring if you want comprehensive coverage with a local touch.