Reviews on Allstate Insurance reveal a lot about what customers really think about their services. With a rich history and a wide range of coverage options, Allstate has become a key player in the insurance market. Understanding the experiences of policyholders can shed light on the effectiveness of their customer service and claims process, giving potential customers insight into what they can expect.

From its founding to its geographical reach, Allstate offers various insurance products that appeal to a diverse clientele. By examining customer testimonials, we can spot trends in satisfaction and identify areas where Allstate excels or falls short compared to its competitors.

Overview of Allstate Insurance

Allstate Insurance is one of the largest and most established insurance companies in the United States, offering a wide range of insurance products to meet the diverse needs of its customers. Known for its slogan, “You’re in good hands,” Allstate provides various services, including auto, home, life, and business insurance. The company aims to deliver reliable coverage options, excellent customer service, and innovative insurance solutions to protect individuals and families across the nation.

Founded in 1931 as a part of the Sears Roebuck Company, Allstate Insurance began with the goal of providing affordable automobile insurance to the average American driver. The company’s innovative approach to insurance, including the introduction of the first direct-to-consumer auto insurance, set it apart from other insurance providers of the time. Over the decades, Allstate has expanded its offerings and has become a publicly traded company, further solidifying its presence in the insurance market.

Geographical Coverage and Availability

Allstate Insurance boasts extensive geographical coverage across the United States, making its products accessible to a large segment of the population. The company operates in all 50 states and provides localized services to meet the specific needs of various communities. Its extensive network of agents ensures that customers receive personalized service and support, regardless of their location.

To illustrate Allstate’s geographical reach and policy availability, here are some key points:

- Allstate serves millions of customers nationwide, with over 12,000 agents working in local communities.

- The company offers a variety of insurance products specifically tailored to meet state regulations and local market conditions.

- Allstate has developed user-friendly digital platforms, allowing customers to manage their policies and file claims easily, regardless of location.

- In addition to traditional coverage, Allstate provides specialized insurance options, such as motorcycle, boat, and pet insurance, catering to a wide range of customer needs.

“Allstate’s commitment to ensuring customer satisfaction is evident in its robust presence in local markets, providing tailored solutions and support.”

Customer Reviews and Experiences: Reviews On Allstate Insurance

Customer feedback plays a crucial role in understanding the strengths and weaknesses of Allstate Insurance. With a mix of positive and negative experiences, policyholders provide insights that can guide potential customers in their decision-making process. By examining these testimonials, we can identify recurring themes that emerge from different users’ interactions with Allstate.

Customer experiences with Allstate Insurance range significantly, reflecting a broad spectrum of satisfaction levels. Many policyholders highlight the ease of the claims process and the accessibility of information through the Allstate app as key advantages. However, there are also reports of dissatisfaction related to customer service and claims handling. It’s essential to evaluate these reviews to gain a comprehensive view of how Allstate operates in real-life scenarios.

Positive Customer Experiences

Numerous reviews express appreciation for Allstate’s responsive customer service and efficient claims processing. Customers often mention the following aspects:

-

Fast Claims Resolution:

Many users report that their claims were processed quickly and with minimal hassle, which is a critical factor in customer satisfaction.

-

Helpful Agents:

Several testimonials highlight the knowledge and support provided by Allstate agents, who assist policyholders in understanding their coverage and navigating through claims.

-

Comprehensive Coverage Options:

Customers appreciate the variety of coverage options available, allowing them to tailor policies to their specific needs.

Negative Customer Experiences

While many reviews are positive, there are notable concerns raised by some policyholders. Common themes in negative feedback include:

-

Customer Service Issues:

Some customers have encountered long wait times when reaching out to customer support, leading to frustration and dissatisfaction.

-

Claims Disputes:

A subset of reviews indicates disagreements over claim amounts or coverage, resulting in negative experiences for those affected.

-

Rate Increases:

Several individuals have commented on unexpected premium increases, which has raised concerns about the affordability and transparency of Allstate’s pricing.

Impact of Customer Service on Overall Satisfaction

The quality of customer service significantly impacts policyholders’ perceptions of Allstate Insurance. Positive interactions often lead to higher satisfaction levels, while negative encounters can detract from the overall experience. Many testimonials emphasize that a responsive and empathetic customer service team can make a substantial difference in resolving issues and enhancing customer loyalty.

In summary, the feedback from Allstate customers reveals a varied landscape of experiences. While many commend the company for its effective claims management and helpful agents, others express valid concerns that underline the importance of continuous improvement in customer service practices. These insights can help prospective customers make informed decisions based on real experiences from their peers.

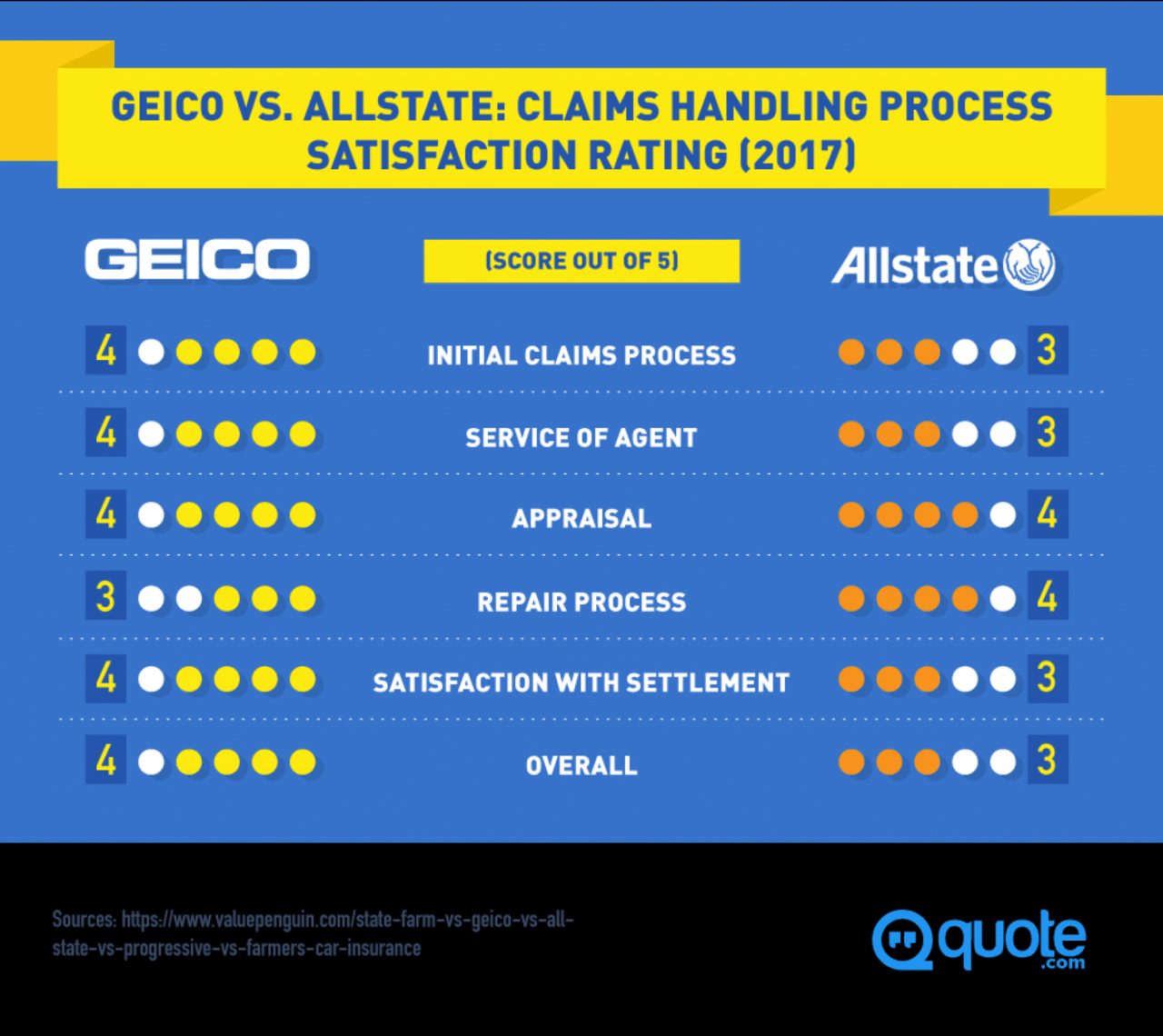

Comparison with Competitors

When considering Allstate Insurance, it’s essential to compare it with other major players in the market. Understanding how Allstate stacks up against competitors provides valuable insights into their strengths and weaknesses in policy offerings and customer satisfaction. Below, we will look at how Allstate compares to companies like State Farm, Geico, and Progressive based on customer reviews and experiences.

Policy Offerings and Customer Satisfaction, Reviews on allstate insurance

Allstate, State Farm, Geico, and Progressive each have unique policy offerings that cater to different customer needs. Analyzing customer reviews reveals significant distinctions in their services and overall satisfaction ratings.

- Allstate: Known for its comprehensive auto and home insurance policies, Allstate offers a wide range of discounts and coverage options. Customer reviews often highlight their user-friendly mobile app and local agent support. However, some users mention higher rates compared to competitors.

- State Farm: State Farm is praised for its personalized service and extensive network of agents. Many customers appreciate their claims process, which is often reported as smooth and efficient. However, some reviews suggest that their rates can also be on the higher side, similar to Allstate.

- Geico: Geico stands out for its competitive pricing and quick online quotes. Reviews frequently commend their easy-to-use online platform and excellent customer service. However, some customers note that their coverage options might be less comprehensive than those of Allstate and State Farm.

- Progressive: Progressive is recognized for its innovative pricing model and the “Name Your Price” tool that allows customers to find policies within their budget. Reviews typically highlight their adaptability to customer needs, though some users express concerns about claim handling and customer service responsiveness.

Customer satisfaction ratings also vary significantly among these competitors. Allstate generally has a solid reputation, but it can lag behind State Farm and Progressive in some areas. For example, according to J.D. Power’s annual customer satisfaction survey, State Farm often ranks higher for customer service and claims satisfaction. Conversely, Geico may lead in overall affordability due to its competitive rates, which appeals to cost-conscious consumers.

In terms of strengths, Allstate is often appreciated for its robust coverage options and claim support. Its weaknesses may stem from higher premiums and variable customer service experiences.

Overall, while Allstate provides a strong array of insurance products, comparing these factors with State Farm, Geico, and Progressive reveals a complex landscape. Customers prioritize different aspects, from pricing to claims handling, making it crucial for potential policyholders to assess their specific needs when choosing an insurance provider.

Claims Process Insights

The claims process is a critical aspect of any insurance experience, and Allstate Insurance is no exception. Understanding how this process works based on customer feedback can offer valuable insights into what future policyholders might expect. When considering Allstate, potential customers often weigh the efficiency and reliability of the claims process, which can significantly influence overall satisfaction and loyalty.

Filing a claim with Allstate typically involves several steps, and many customers have shared their experiences regarding the efficiency of these steps. Generally, the process starts with reporting the incident, either through the Allstate app, website, or by contacting an agent directly. After reporting, a claims adjuster usually gets assigned to assess the situation. This part of the process can vary in speed depending on the complexity of the claim and the resources available.

Turnaround Times for Claims

Customers frequently report varying turnaround times for their claims, which can affect their overall perception of Allstate. While some users have praised the quick response times, others have experienced delays. Here are some key points regarding turnaround times:

- Simple claims, such as minor auto accidents, often see resolution within a week, with payments processed and dispatched quickly.

- More complicated claims, like those involving property damage or liability issues, may take several weeks or even months to settle as they require more thorough investigation.

- According to customer feedback, Allstate’s mobile app has streamlined the process, allowing for quicker submissions and updates, enhancing user experience.

“The claims process was straightforward, and I received my payout faster than I expected.” – Allstate Customer

Impact on Customer Loyalty and Retention

The claims experience significantly impacts customer loyalty and retention for Allstate. When claims are handled efficiently, customers are more likely to renew their policies and recommend Allstate to others. The following factors illustrate how claims experiences shape customer relationships:

- Positive claims experiences lead to high satisfaction rates, encouraging customers to remain with Allstate for future coverage needs.

- Complicated or delayed claims can result in frustration, negatively affecting customer retention and potentially driving clients to competitors.

- Communication throughout the claims process, including regular updates and transparency, has been noted as a major factor in improving customer trust and loyalty.

“My claim was settled quickly, and the constant updates kept me informed and stress-free. I’m sticking with Allstate.” – Satisfied Client

If you’re considering different insurance options, checking out allstate insurance company reviews can be super helpful. It gives you a glimpse into other people’s experiences, helping you make a better-informed decision. On the other hand, if you’re looking for life insurance, getting a thrivent life insurance quote can provide you with specific details tailored to your needs.

It’s all about finding the right fit for you!

When it comes to choosing an insurance provider, diving into allstate insurance company reviews can really open your eyes to what customers think about their services. Plus, if you’re in the market for life insurance, you should definitely grab a thrivent life insurance quote to see what options are available that suit your budget and coverage needs.

It’s a smart way to ensure you’re making the best choice!