Reviews of Allstate insurance kick off a deep dive into the experiences of customers navigating the claims process and customer service. Whether you’re considering Allstate for your insurance needs or just curious about what others have to say, these insights provide a comprehensive look at the perks and pitfalls of their services. From testimonials highlighting personal stories to discussions around coverage options, this overview aims to equip you with the knowledge you need to make informed decisions.

As we explore customer experiences, you’ll learn about the various coverage options Allstate offers, how they stack up against competitors, and the unique features that set them apart. We’ll also touch on Allstate’s financial stability, pricing strategies, and available discounts, giving you a well-rounded perspective on what to expect when dealing with this insurance giant.

Customer Experiences with Allstate Insurance

Many customers share their experiences with Allstate Insurance, revealing a variety of perspectives on their services, particularly regarding the claims process. These testimonials highlight both the positive aspects and the challenges faced when dealing with Allstate, shaping customer loyalty through unique interactions.

The claims process is often where customers have the most direct interaction with Allstate, and these experiences can significantly influence their overall satisfaction with the company. While some customers praise Allstate for its efficient handling of claims, others have reported difficulties that can lead to frustration.

Testimonials on Claims Process

Customer testimonials regarding the claims process at Allstate illustrate a range of experiences. Many customers have expressed gratitude for the timely responses and supportive communication they received when filing claims. For instance, a customer noted,

“Allstate made my claim process so easy. I submitted the paperwork, and within days, I received my settlement.”

Positive experiences like this demonstrate Allstate’s commitment to customer service and efficiency.

However, not all feedback is positive. Some customers have voiced concerns about delays and unclear communication. One user commented,

“I felt like I was in the dark for weeks after filing my claim. I had to call multiple times just to get updates.”

Such challenges can lead to dissatisfaction and impact customer loyalty, prompting some to consider alternatives.

Challenges in Customer Service

Despite its strengths, Allstate’s customer service has its share of challenges that customers frequently encounter. These issues can hinder the overall customer experience and create feelings of frustration or confusion. Many customers report difficulty in reaching representatives or experiencing long wait times when calling for support. This inconsistency can detract from the positive aspects of the insurance experience.

Additionally, some customers have highlighted the complexity of policy details. Many found the process of understanding their coverage options to be less than straightforward. This lack of clarity can lead to misunderstandings regarding what is covered and what is not, resulting in dissatisfaction during critical times of need.

Positive Experiences and Customer Loyalty

Positive experiences with Allstate have been pivotal in fostering customer loyalty. Many customers who have had successful claims or exceptional support from representatives often express a desire to remain with Allstate. For example, one customer shared,

“After my car accident, the claims adjuster was so helpful and made everything easy. I can’t imagine switching to another insurer after that.”

Such testimonies illustrate how effective customer service can create a lasting bond with clients.

Moreover, consistent positive experiences often lead to referrals. Satisfied customers frequently recommend Allstate to friends and family, further solidifying their loyalty and the company’s reputation. This word-of-mouth endorsement is a powerful tool that Allstate leverages, highlighting the importance of maintaining high standards in service and support.

In conclusion, customer experiences with Allstate Insurance are a blend of both praise and challenges. While many customers appreciate the efficiency of the claims process and the support provided, others face hurdles that impact their satisfaction. Understanding these experiences offers valuable insights into customer loyalty and the effectiveness of Allstate’s services.

Coverage Options and Comparisons

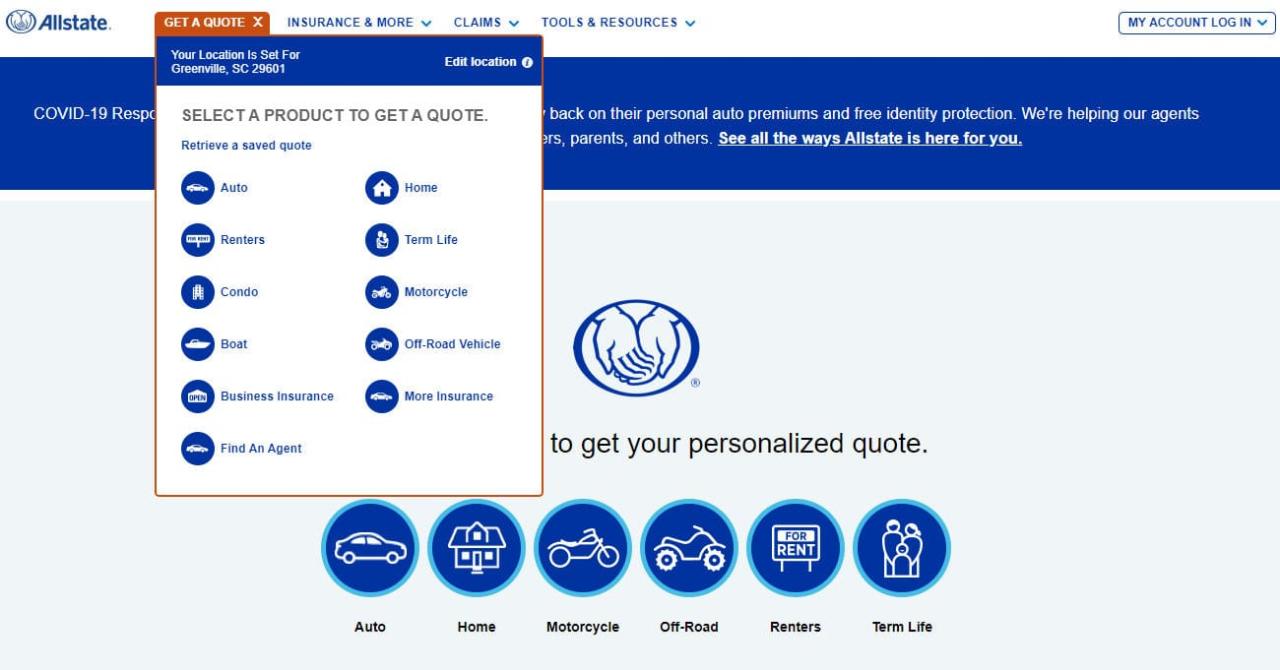

Allstate Insurance offers a comprehensive range of coverage options designed to meet the diverse needs of its customers. From auto to home insurance, their policies not only provide essential protection but also cater to specific customer preferences. Understanding these coverage options and how they compare to competitors is vital for anyone considering insurance solutions.

Allstate provides a variety of insurance products, including but not limited to auto insurance, home insurance, renters insurance, motorcycle insurance, and life insurance. Each product comes with customizable options that allow policyholders to tailor their coverage according to their unique circumstances.

Types of Insurance Coverage Offered by Allstate

Allstate’s offerings encompass a wide array of coverage types, ensuring that customers can find what suits their individual needs. Here are some key categories:

- Auto Insurance: Covers liability, collision, comprehensive, personal injury protection, and uninsured/underinsured motorist coverage.

- Homeowners Insurance: Offers dwelling protection, personal property coverage, liability protection, and additional living expenses in case of a covered loss.

- Renters Insurance: Provides coverage for personal possessions, liability protection, and additional living expenses.

- Motorcycle Insurance: Includes coverage for bodily injury, property damage, and medical payments.

- Life Insurance: Offers term life and whole life policies to suit various financial goals and needs.

Comparison of Coverage Limits and Premiums

When evaluating Allstate’s insurance products, it’s essential to consider how their coverage limits and premiums stack up against industry competitors. Allstate generally offers competitive pricing and flexible coverage limits that can adapt to different financial situations and risk appetites.

For instance, while many competitors may have higher premiums for similar coverage levels, Allstate often balances premiums with discounts for safe driving, bundling policies, and claims-free history. Customers can benefit from:

- Customizable Coverage Limits: Policyholders have the option to increase or decrease their limits, affecting the overall premium.

- Discounts: Discounts for bundling multiple policies or maintaining a claims-free record can significantly lower costs.

- Unique Coverage Options: Features like accident forgiveness and vanishing deductibles can provide additional savings and peace of mind.

Unique Features of Allstate’s Policies

Allstate distinguishes itself in the insurance market with several unique features that enhance customer experience and provide added value. These features can include:

- Claims Satisfaction Guarantee: If customers are not satisfied with their claims service, Allstate may refund their premium.

- Safe Driving Bonus: Customers can earn a bonus for safe driving behavior, promoting not just safety but also financial rewards.

- Personalized Service: Allstate agents work closely with customers to tailor coverage, ensuring that individual needs are met.

- Mobile App: Their user-friendly app allows customers to manage their policies, file claims, and access important information conveniently.

These features not only set Allstate apart but also reflect their commitment to providing reliable customer service and innovative solutions in the insurance sector.

Financial Strength and Reliability

When it comes to choosing an insurance provider, financial strength and reliability are crucial factors that can influence your decision. Allstate Insurance has established itself as a prominent player in the insurance market, and understanding its financial ratings can provide peace of mind for customers. This segment delves into Allstate’s financial ratings, its performance during economic challenges, and how this impacts customer trust.

Allstate’s financial stability is often evaluated by leading ratings agencies such as A.M. Best and Moody’s. These agencies assess the company’s ability to meet its ongoing insurance obligations, which is vital for customers looking for long-term security in their policies.

Financial Ratings, Reviews of allstate insurance

Allstate has consistently received strong ratings from major financial rating agencies. For instance, A.M. Best has assigned Allstate an “A+” rating, indicating superior financial strength. Similarly, Moody’s has given Allstate a rating of “A1,” reflecting its sound financial health and resilience in various economic climates. These ratings are important because they suggest that Allstate has the resources needed to fulfill claims, which is a top priority for any insurance policyholder.

Performance During Economic Downturns

Allstate’s track record during economic downturns and natural disasters showcases its reliability. For instance, during the 2008 financial crisis, Allstate maintained its financial ratings and continued to pay out claims, proving its stability in turbulent times. Additionally, in the wake of significant natural disasters, such as Hurricane Katrina, Allstate demonstrated its commitment to policyholders by expediting claims processing and providing timely financial support to those affected. This performance highlights not only the company’s financial strength but also its dedication to customer service and trust.

Implications for Customer Trust

The financial health of Allstate directly impacts customer trust and the perception of policy security. A company with strong financial ratings and a history of reliable performance fosters confidence among its policyholders. Customers can feel assured that their claims will be handled efficiently and that the company will remain solvent through various challenges. According to a survey conducted by J.D. Power, customers are more likely to renew their policies with insurers that demonstrate financial stability, further underscoring the importance of Allstate’s strong financial foundation in building lasting relationships with clients.

“Financial strength is not just about ratings; it’s about the commitment to pay claims and support customers in challenging times.”

Pricing Strategies and Discounts: Reviews Of Allstate Insurance

Allstate Insurance employs a multifaceted pricing strategy designed to appeal to a wide range of consumers while still maintaining competitive rates in the insurance market. By utilizing various factors, including individual risk assessments and regional considerations, Allstate can tailor its prices to match the needs of its customers. Understanding these strategies and available discounts can help consumers make informed decisions and potentially save money on their insurance premiums.

One of the key aspects of Allstate’s pricing structure is its reliance on personalized pricing models, which take into account individual driving habits, credit scores, and even home safety features. This strategy sets Allstate apart from some competitors who may use more generalized pricing models. While the base rate varies, Allstate allows customers to customize their coverage, which can lead to a more tailored fit for their specific needs.

Available Discounts

Allstate offers a variety of discounts that can significantly reduce the cost of premiums for its policyholders. Understanding these discounts is essential for maximizing savings when purchasing insurance.

Some of the major discounts available include:

- Multi-Policy Discount: Customers who bundle multiple insurance policies, such as home and auto, can enjoy substantial savings.

- Safe Driving Discount: Drivers who maintain a clean driving record may qualify for this discount, which rewards responsible driving behavior.

- New Car Discount: Insuring a new vehicle often results in lower premiums due to the advanced safety features of modern cars.

- Anti-Theft Device Discount: Vehicles equipped with approved anti-theft devices can lead to a discount on auto insurance premiums.

- Student Discounts: Full-time students with good academic records can benefit from discounts, recognizing their commitment to education and safe driving.

Additionally, Allstate offers discounts for paying your premium in full, setting up automatic payments, and even for being claim-free for a certain number of years.

Maximizing Savings

Consumers looking to maximize their savings when purchasing Allstate insurance can employ several effective strategies. By understanding the intricacies of Allstate’s discount offerings, customers can take actionable steps to lower their premiums.

To effectively save on insurance costs, consider the following strategies:

- Research and Compare: Before committing to a policy, it’s beneficial to compare quotes from Allstate with those from competitors. This allows consumers to find the best deal tailored to their coverage needs.

- Take Advantage of Bundling: Consider bundling different types of insurance with Allstate to qualify for the multi-policy discount, resulting in overall savings.

- Participate in Safe Driving Programs: Engaging in programs like Drivewise, which rewards safe driving habits, can help reduce premiums further.

- Review Coverage Needs Regularly: Periodically reassessing your coverage can ensure that you’re not over-insured or under-insured, allowing for potential premium adjustments.

- Maintain a Good Credit Score: Since Allstate considers credit scores for pricing, keeping a good score can lead to lower premiums.

By implementing these strategies, consumers can not only secure lower rates but also ensure they are adequately covered without overspending.

If you’re wondering whether Allstate is a good homeowners insurance company , it’s worth looking into their coverage options and customer reviews. Many homeowners in the area feel secure with the policies they offer, and their customer service tends to be responsive. Plus, if you’re in Gallatin, TN, you can easily access Allstate insurance Gallatin TN for local support and expertise tailored to your needs.

For residents in Gallatin, TN, finding reliable coverage is key, which is why checking out Allstate insurance Gallatin TN could be beneficial. They offer a range of options to fit various budgets and needs, making it easier for homeowners to protect their investments. And if you’re curious about their reputation, you might also explore whether Allstate is a good homeowners insurance company overall to get a broader perspective.