cit bank fdic insured sets the stage for this enthralling narrative, offering readers a glimpse into a story that highlights the significance of banking safety. CIT Bank stands out in the financial sector, not only as a trusted institution but also as a provider of FDIC insurance that protects depositors’ interests. Understanding FDIC insurance and how it applies to CIT Bank’s offerings is crucial for anyone looking to secure their hard-earned money.

By diving into the specifics of FDIC insurance, you’ll discover how it acts as a safety net, ensuring that your deposits are protected even in unfortunate events like bank failures. The features of CIT Bank’s FDIC coverage provide an added layer of confidence for depositors, making it an appealing choice for securing savings.

Overview of CIT Bank and FDIC Insurance

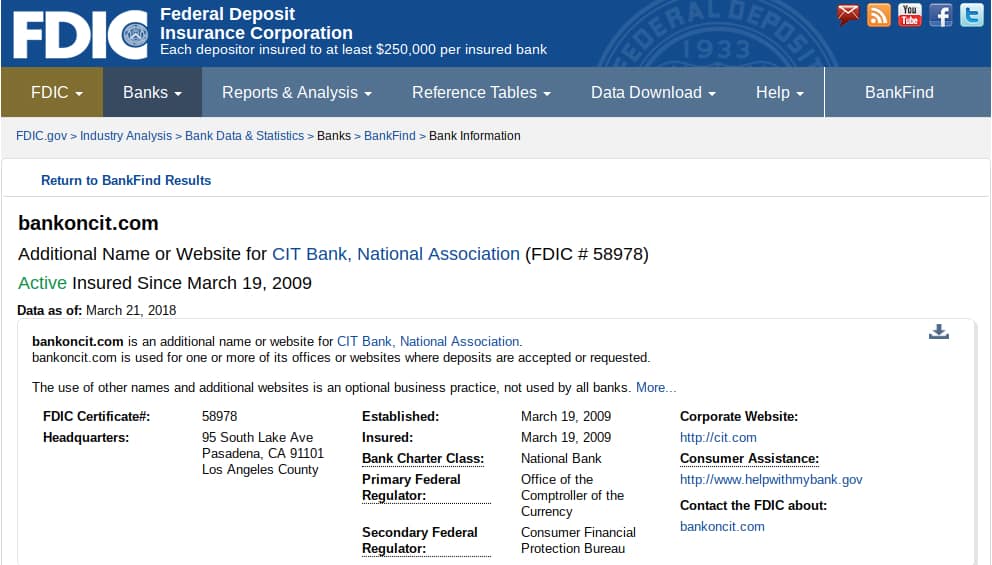

CIT Bank is a significant player in the financial sector, offering a range of banking products tailored for both individuals and businesses. As a subsidiary of First Citizens Bank, CIT Bank focuses on providing competitive savings accounts, certificates of deposit (CDs), and other financial services that emphasize customer needs and innovative banking solutions. One of the cornerstone features of CIT Bank is its commitment to ensuring the safety and security of its depositors through FDIC insurance.

FDIC insurance, or Federal Deposit Insurance Corporation insurance, acts as a safety net for depositors, protecting their funds in the event of a bank failure. This insurance is essential in fostering trust in the banking system, as it guarantees the security of deposits up to $250,000 per depositor, per insured bank, for each account ownership category. This means that customers can have peace of mind knowing that their hard-earned money is safeguarded against unforeseen circumstances.

Features of CIT Bank’s FDIC Coverage

CIT Bank’s FDIC coverage comes with several key features that enhance depositor security and confidence. Understanding these features is crucial for anyone considering where to place their savings.

- Coverage Limit: CIT Bank provides FDIC insurance for deposits up to $250,000 per depositor. This limit applies separately to different ownership categories, so individuals can maximize their coverage by strategically opening accounts in various categories.

- Multi-Account Ownership: The FDIC insures accounts held in different ownership categories, such as individual accounts, joint accounts, and retirement accounts. Customers can increase their total insured amount by diversifying their accounts across these categories.

- Account Types Covered: CIT Bank’s FDIC insurance covers a wide range of deposit accounts, including savings accounts, checking accounts, and CDs. This ensures that all types of deposits are protected, providing comprehensive coverage for depositors.

- Bank’s Stability: As a member of the Federal Reserve System, CIT Bank adheres to strict regulatory requirements, ensuring its financial stability and reliability. This adds an extra layer of security for depositors, knowing that their bank operates under federal supervision.

FDIC insurance is not just a safety feature; it’s a fundamental aspect of the trust and reliability that customers expect from their financial institutions.

Understanding the specifics of CIT Bank’s FDIC coverage helps customers make informed decisions about where to place their funds. By taking advantage of these features, depositors can optimize their savings while enjoying the peace of mind that comes from knowing their deposits are insured.

Benefits of FDIC Insurance with CIT Bank

Having your funds safeguarded by the Federal Deposit Insurance Corporation (FDIC) while banking with CIT Bank brings peace of mind and financial security. This insurance covers deposits in case of a bank failure, ensuring that your hard-earned money remains protected even in uncertain financial times. With CIT Bank, customers can enjoy a range of benefits associated with FDIC insurance, making it a wise choice for those looking to save or invest.

One of the primary advantages of FDIC insurance is the level of safety it provides for depositors. FDIC insurance covers up to $250,000 per depositor, per insured bank, for each account ownership category. This means that individuals can rest assured knowing that their deposits are secure, even if the bank encounters financial difficulties. In contrast, non-FDIC-insured accounts pose a greater risk; in the event of a bank failure, depositors may lose some or all of their funds, depending on the institution’s stability.

Comparative Safety of FDIC-Insured Accounts

The distinction between FDIC-insured accounts and their non-FDIC counterparts highlights the critical role of insurance in protecting funds. FDIC insurance serves as a safety net that can significantly reduce financial risk. Here are the key points that Artikel the safety of FDIC-insured accounts:

- Security During Bank Failures: In the rare event that a bank fails, FDIC insurance ensures that depositors can recover their insured funds quickly, typically within a few days.

- Peace of Mind: Knowing that deposits are insured up to $250,000 allows account holders to focus on their financial goals without the constant worry of losing their savings.

- Stability in Economic Downturns: During economic crises, FDIC insurance provides a layer of protection that can help maintain consumer confidence in the banking system.

“FDIC insurance covers up to $250,000 per depositor, per insured bank, for each account ownership category.”

These features demonstrate how vital FDIC insurance is for depositors at CIT Bank. During instances like the 2008 financial crisis, many individuals benefited from FDIC coverage, which prevented significant losses and helped stabilize the economy. Such historical examples illustrate the importance of having FDIC insurance and highlight the reliability of CIT Bank as a trusted institution where your savings can thrive safely.

Types of Accounts at CIT Bank that are FDIC Insured

CIT Bank offers a variety of account types that are protected by FDIC insurance, ensuring your deposits are safe and secure. This insurance serves as a safety net, providing peace of mind to account holders by protecting their funds up to the standard insurance amount, currently set at $250,000 per depositor, per insured bank, for each account ownership category.

Among the various account types offered by CIT Bank, several are eligible for FDIC coverage. It’s essential to understand which accounts qualify and the specific conditions that must be met to maintain that insurance. Here’s an overview of the accounts you can consider:

Eligible Account Types

Understanding the different account types can help you choose the best options for your financial needs. Below are the primary account types at CIT Bank that are covered by FDIC insurance:

- High Yield Savings Account: Offers competitive interest rates while allowing easy access to your funds.

- Money Market Account: Combines features of checking and savings accounts, often with higher interest rates and limited check-writing abilities.

- Certificates of Deposit (CDs): Fixed-term deposits that usually offer higher interest rates compared to regular savings accounts, with terms ranging from a few months to several years.

- Checking Accounts: Some checking accounts at CIT Bank may also qualify for FDIC insurance, providing daily access to funds while earning interest.

It’s important to maintain your FDIC insurance by ensuring your total deposits across accounts do not exceed the insured limit. For joint accounts, each co-owner is insured up to $250,000, effectively doubling the coverage.

Interest Rates and Features Table

To help you make an informed decision, here’s a comparison of interest rates and features of the FDIC-insured accounts at CIT Bank.

| Account Type | Interest Rate (APY) | Minimum Balance | Monthly Fee | Access |

|---|---|---|---|---|

| High Yield Savings Account | 0.50% | $100 | $0 | Online/ATM |

| Money Market Account | 0.45% | $25,000 | $0 | Online/Check Writing |

| 12-Month CD | 1.00% | $1,000 | $0 | Not Accessible |

| Checking Account | 0.01% | $0 | $0 | Online/ATM |

“FDIC insurance is crucial for safeguarding your deposits and ensuring stability in your financial journey.”

Strategies for Maximizing FDIC Insurance with CIT Bank: Cit Bank Fdic Insured

Maximizing your FDIC insurance coverage is crucial for safeguarding your deposits with CIT Bank. Understanding the various strategies available can help you protect your savings while taking full advantage of the benefits that come from FDIC insurance. With proper planning, you can ensure that your money is secure, allowing you to focus on your financial goals.

To fully leverage FDIC insurance, consider utilizing multiple accounts at CIT Bank. This strategy not only increases your overall insured amount but also provides a means to diversify your savings. Each depositor is insured up to $250,000 per insured bank for each account ownership category. Knowing how to navigate this framework can significantly enhance your coverage.

Multiple Accounts to Maximize Coverage, Cit bank fdic insured

Opening multiple accounts at CIT Bank can be an effective way to maximize FDIC insurance. Here are a few methods to consider:

- Individual Accounts: Each individual account holder can have up to $250,000 insured. If you have several personal accounts, each will be insured separately, allowing for greater protection.

- Joint Accounts: If you open a joint account with another person, both account holders are insured for up to $250,000 each. This means a joint account can potentially provide up to $500,000 in coverage.

- Retirement Accounts: Certain retirement accounts, such as IRAs, have their own coverage limits. Having both a retirement account and a standard savings account at CIT Bank can increase your total insured amount.

Each of these account types contributes to your overall insurance limits. By strategically managing your accounts, you can ensure that your funds are adequately protected.

Diversifying Savings While Ensuring Coverage

Diversifying your savings across different account types can be vital for financial security while maintaining FDIC insurance. Here are some insights on how to effectively diversify your savings:

- High-Yield Savings Accounts: Utilizing CIT Bank’s high-yield savings accounts can help you earn interest while keeping your funds safe. These accounts provide a competitive interest rate, ensuring your money grows even within the insured limit.

- Certificates of Deposit (CDs): CDs can offer higher interest rates for locked-in periods. Using multiple CDs for different terms can diversify your savings strategy and remain within insurable limits.

- Money Market Accounts: These accounts often combine features of checking and savings, providing liquidity while still being insured. Maintaining various money market accounts can also enhance your coverage.

By spreading your funds across these diverse account types, you not only maximize your FDIC insurance but also potentially increase your interest earnings.

Monitoring and Managing Deposits

Staying within the insured limits requires diligent monitoring and management of your deposits. Consider these strategies:

- Regular Account Reviews: Schedule periodic reviews of your account balances to ensure they remain below the insured limits. This is especially important if you have multiple accounts across different institutions.

- Keeping Track of Ownership Categories: Understand the different ownership categories recognized by the FDIC. This can help you structure your accounts effectively for maximum coverage.

- Using Financial Tools: Utilize budgeting and financial management tools to keep tabs on your savings and investments. These tools can alert you when balances approach FDIC limits, allowing you to make adjustments as needed.

By actively managing your deposits, you can ensure that your funds remain within the safe zone of FDIC insurance, providing peace of mind as you work towards your financial objectives.

If you’re considering opening an account, you might be wondering is CIT Bank FDIC insured. This is a crucial factor to ensure your funds are protected. On the other hand, if you’re looking into insurance options, checking out Allstate insurance reviews can give you a good sense of customer satisfaction and coverage quality. Both topics are essential when making informed financial decisions.

When you’re evaluating banks, knowing if CIT Bank is FDIC insured can provide peace of mind that your money is safe. Meanwhile, insurance decisions are equally important, and reading up on Allstate insurance reviews can help you understand what to expect from their services. It’s all about making sure you’re covered in both areas!