Amica life insurance quote is your first step in understanding the options available for securing your future and that of your loved ones. With various life insurance policies tailored to fit different needs, Amica stands out by offering unique benefits and features that can make a significant difference in your coverage choices. From term life to whole life options, knowing what Amica has to offer is crucial in finding the right policy for you.

In this exploration, we’ll break down the types of insurance available, how to obtain a quote easily through their website, and what factors can influence your premium rates. Whether you’re a first-time buyer or looking to switch providers, navigating through Amica’s offerings can empower you to make informed decisions about your life insurance coverage.

Understanding Amica Life Insurance

Amica Life Insurance is a trusted name in the insurance industry, offering a range of policies tailored to meet diverse customer needs. With a focus on customer service and satisfaction, Amica stands out among insurance providers. This section explores the various life insurance options available from Amica, highlighting their distinctive features and benefits.

Amica provides multiple types of life insurance policies, including term life insurance and whole life insurance, each serving different financial planning strategies and preferences. Navigating these options can help individuals make informed decisions that align with their long-term goals.

Types of Life Insurance Policies Offered by Amica

Amica offers two primary types of life insurance policies:

- Term Life Insurance: This policy provides coverage for a specific term, typically ranging from 10 to 30 years. It’s ideal for those seeking affordable premiums with a clear set time frame for protection.

- Whole Life Insurance: This permanent policy covers the insured for their entire lifetime, combining a death benefit with a cash value component that grows over time. It’s suited for individuals looking for long-term investment options and lifetime coverage.

Benefits and Features of Choosing Amica for Life Insurance

Selecting Amica for life insurance comes with several advantages that appeal to both new and existing customers. Below are key benefits that highlight why Amica is a commendable choice:

- Strong Financial Stability: Amica consistently receives high ratings from independent rating agencies, indicating a solid financial foundation that assures policyholders of long-term coverage.

- Customer-Centric Service: Amica is known for its excellent customer service, providing policyholders with a supportive experience throughout their insurance journey.

- Flexible Premium Payments: Policyholders can choose from various premium payment schedules, making it easier to manage their finances.

- Customizable Coverage: Amica offers riders that allow customers to tailor their policies to fit their specific needs, including options for accelerated death benefits and accidental death coverage.

Comparison of Amica Life Insurance with Other Popular Providers

When it comes to choosing the right life insurance, comparing different providers can reveal significant differences in offerings. Below is a comparison chart showcasing how Amica stacks up against some popular life insurance providers:

| Provider | Type of Insurance | Customer Satisfaction Rating | Financial Strength Rating |

|---|---|---|---|

| Amica | Term & Whole Life | Excellent | A+ (Superior) |

| State Farm | Term & Whole Life | Good | A++ (Superior) |

| Allstate | Term & Whole Life | Good | A+ (Superior) |

| Prudential | Term & Whole Life | Very Good | A+ (Superior) |

Obtaining an Amica Life Insurance Quote

Getting a life insurance quote from Amica is a straightforward process that can help you understand your options and find a policy that meets your needs. Whether you’re looking for coverage for yourself or your loved ones, knowing how to request a quote efficiently can save you time and ensure you have the right information at your fingertips.

To obtain an Amica life insurance quote, you can leverage the user-friendly Amica website, which is designed to guide you through the necessary steps. First, you should visit the Amica homepage and navigate to the life insurance section. There, you will find a “Get a Quote” option that you can click on. The online process typically involves filling out a questionnaire that gathers essential details about your lifestyle, preferences, and the type of coverage you are considering.

Steps to Request an Online Quote

Understanding the steps involved in obtaining your quote is crucial. Here’s a breakdown of the process that guides you through the online quoting system:

1. Visit the Amica Website: Navigate to the official Amica website and locate the life insurance section.

2. Select “Get a Quote”: Click on the “Get a Quote” button typically found on the life insurance page.

3. Complete the Questionnaire: You will be prompted to provide information about yourself, including:

– Age

– Gender

– Health status

– Coverage amount desired

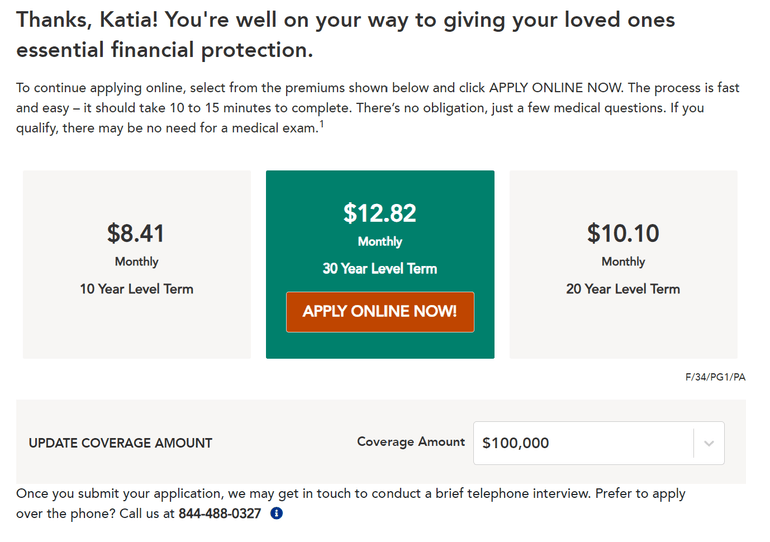

4. Review Your Quote: After submitting your information, you will receive an estimated quote based on the details you provided.

5. Consult with an Agent: If needed, you can arrange a consultation with an Amica insurance agent for further clarification or adjustments to your quote.

Using Amica’s online tools can facilitate a smooth quoting experience, allowing you to compare different coverage options and find the best fit for your financial needs.

Information Required for a Quote

When applying for a life insurance quote, providing accurate information is essential for obtaining a reliable estimate. The following details are typically required:

– Personal Information: Full name, date of birth, and address.

– Health History: Information regarding any existing medical conditions, medications, and lifestyle choices such as smoking or alcohol use.

– Financial Details: A rough idea of your income and any existing insurance policies you may have.

– Desired Coverage Amount: The amount of life insurance you think you need based on your financial obligations and dependents.

By gathering this information ahead of time, you can streamline the quoting process and ensure that the quote you receive is tailored to your specific situation.

“Accurate information leads to better estimates, making it vital to be precise when filling out the life insurance quote questionnaire.”

Factors Influencing Amica Life Insurance Quotes

When it comes to determining life insurance premiums with Amica, several key factors are taken into account. Understanding these factors can help you make informed decisions about your policy and potentially lower your rates. Life insurance is a personalized product, and the rates reflect the unique circumstances of each applicant.

One of the primary considerations in calculating insurance premiums is the applicant’s age, health, and lifestyle choices. Each of these elements plays a significant role in assessing risk, which in turn influences the cost of coverage. For example, younger individuals may benefit from lower premiums due to their generally lower risk of health issues. Conversely, pre-existing health conditions or risky lifestyle choices can lead to higher rates as they increase the likelihood of claims.

Impact of Age, Health, and Lifestyle Choices on Insurance Rates

The following details the impact of different factors influencing Amica life insurance quotes. Understanding these elements can help you prepare and potentially save money when obtaining a policy.

- Age: As individuals age, the risk of health issues increases. Generally, younger applicants secure lower premiums, while older individuals, particularly those over 50, may face higher rates due to increased health risks.

- Health: Your overall health status is one of the most significant factors in determining your premium. Conditions such as high blood pressure, diabetes, or heart disease can lead to elevated rates. Insurers may require medical exams to evaluate your health accurately.

- Lifestyle Choices: Choices such as smoking, excessive alcohol consumption, or engaging in high-risk activities can significantly increase premiums. Leading a healthy lifestyle, including regular exercise and a balanced diet, often results in more favorable rates.

The following table highlights common health conditions and their typical effects on insurance quotes:

| Health Condition | Effect on Quotes |

|---|---|

| Hypertension | Moderate increase (10-20%) depending on management |

| Diabetes | Significant increase (20-50%) based on control and complications |

| Heart Disease | Very high increase (50%+) depending on severity |

| Obesity | Moderate increase (10-30%) based on BMI |

| Smoker | High increase (30-50%) compared to non-smokers |

“Understanding your health profile and lifestyle choices is essential for obtaining a competitive life insurance quote.”

Each of these factors contributes to the overall risk assessment performed by Amica when determining life insurance premiums. Being aware of these elements can empower you to take proactive steps, potentially leading to more favorable insurance rates.

Customer Experiences with Amica Life Insurance

The customer experience with Amica Life Insurance can significantly influence potential policyholders’ decisions. Understanding how current and past customers perceive the service, claims process, and overall satisfaction can provide valuable insight into what one might expect from the company. By evaluating the collective feedback, we can identify both the strengths and weaknesses of Amica’s offerings.

Amica Life Insurance has garnered a variety of reviews that highlight the experiences customers have had with their claims process. The feedback ranges from overwhelmingly positive to some criticisms, illustrating a diverse range of customer expectations and outcomes. Here’s a closer look at the specifics of these experiences.

Claims Process Experiences

Many customers have shared their experiences regarding Amica’s claims process, which plays a crucial role in determining overall satisfaction. The claims process is often a pivotal moment for policyholders, as it significantly influences their perception of the insurer’s reliability and dedication. Various case studies reflect both commendable successes and notable challenges.

Positive experiences frequently emphasize the following points:

- Quick and straightforward claims process: Many policyholders report that Amica’s claims process is efficient and user-friendly, allowing for timely payouts.

- Helpful customer service representatives: Numerous customers appreciate the knowledge and support provided by Amica’s representatives during the claims process, which helps ease any associated stress.

- Transparency: Clients have noted that Amica provides clear information regarding what to expect during the claims process, leading to a smoother experience overall.

Conversely, some customers have encountered challenges, which highlight areas for improvement:

- Delayed response times: A portion of customers expressed frustration with longer-than-expected wait times for claim approvals or responses from the claims department.

- Complex documentation requirements: Some policyholders felt overwhelmed by the amount of paperwork needed to process their claims, which could lead to confusion and delays.

- Dispute over claim denials: There have been instances where customers reported their claims being denied, leading to dissatisfaction and a feeling of being unsupported.

Case Studies of Customer Feedback, Amica life insurance quote

Examining specific case studies can provide a clearer picture of customer experiences with Amica Life Insurance.

Positive Case Study:

One policyholder shared their experience of claiming benefits after a family member’s passing. They reported a seamless process where Amica quickly assessed the claim, provided clear instructions, and issued payment within a week. The family felt supported throughout the process, highlighting Amica’s compassionate customer service.

Negative Case Study:

In another instance, a customer detailed their experience of having a claim denied due to what Amica cited as insufficient documentation. This customer expressed frustration, stating they believed they had provided everything required. The lack of clarity and communication during this time led to dissatisfaction, as they felt their concerns were not adequately addressed.

The key takeaways from these experiences can be summarized into pros and cons:

Pros of Amica Life Insurance:

- Efficient claims process with timely payments.

- Responsive and knowledgeable customer service.

- Clarity and transparency in communication.

Cons of Amica Life Insurance:

- Instances of delays in claims processing.

- Complex requirements for documentation.

- Occasional disputes over claims that lead to dissatisfaction.

If you’re wondering whether Allstate is a good homeowners insurance company , it’s worth checking out their customer reviews and coverage options. Many people find that they offer a decent mix of benefits and customer service. If you’re in Tulsa, OK, you can also look into Allstate insurance in Tulsa, OK to see how they cater specifically to local needs, which might help you make a more informed decision.

If you’re wondering whether Allstate is a good homeowners insurance company , you’ll find that they offer a range of policies that cater to different needs. Their customer service is often praised, and they have various discounts available, making it a solid choice for many homeowners. If you’re in the Tulsa area, checking out Allstate insurance in Tulsa OK can help you find the right coverage that fits your lifestyle and budget.

When considering your options, it’s essential to look into Allstate insurance in Tulsa OK , as they have a good reputation in the region. Their policies are tailored for local homeowners, and many find their coverage options to be comprehensive. Plus, if you want to explore whether Allstate is a good homeowners insurance company , their customer feedback can provide valuable insights into their reliability and service.